Explaining different cryptocurrency types. Coins, tokens, NFTs

Jan 16, 2026 21:25

Let’s Break Down the Main Types of Cryptocurrencies: Bitcoin, Ethereum, Tokens (Stablecoins, Utility, Security) and NFTs

If you’re just getting into crypto, the first thing that hits you is how many different coins and tokens are out there. It can feel overwhelming, but once you understand the basics, everything starts to make sense. Let’s go through the main categories step by step, like we’re sitting at a coffee shop and I’m explaining this to a friend who’s just curious.

Coins vs Tokens: The Big Difference

Crypto assets are divided into two main groups: coins and tokens. They sound similar, but they’re actually quite different in how they work and what they’re used for.

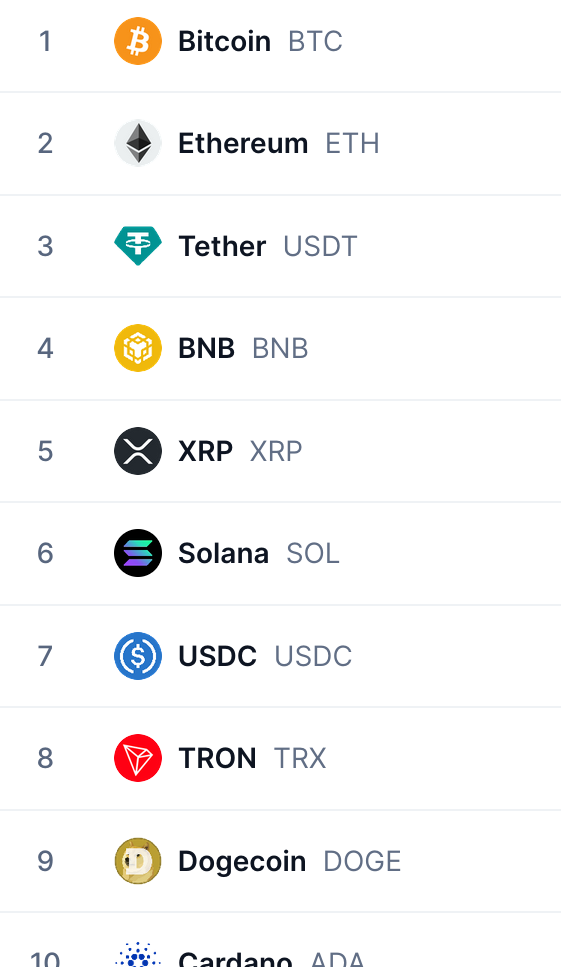

Coins are the native currency of their own blockchain. Think of them as the “official money” of that particular network.

- Bitcoin (BTC) is the coin of the Bitcoin blockchain.

- Ethereum (ETH) is the coin of the Ethereum blockchain.

- BNB is the coin of Binance Smart Chain (now BNB Chain).

- AVAX is the coin of Avalanche.

These coins are what actually power the network: you pay transaction fees with them, miners or validators earn them as rewards, and they’re built right into the core of the blockchain. Without the coin, the network simply wouldn’t run.

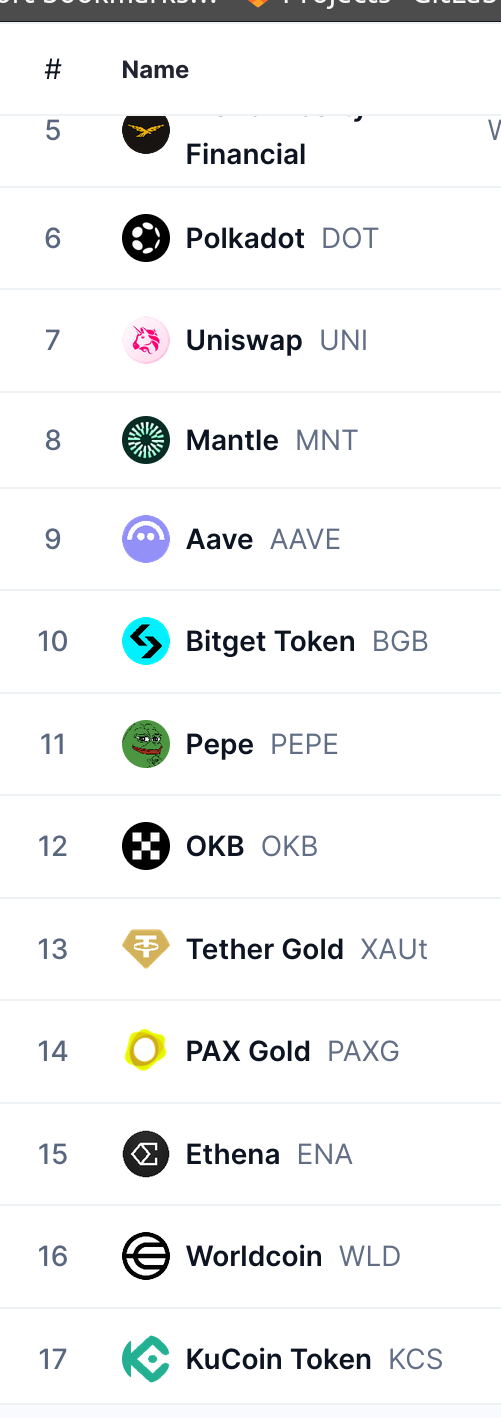

Tokens, on the other hand, are built on top of an existing blockchain. They don’t have their own network; they borrow someone else’s infrastructure (usually Ethereum, but also BNB Chain, Solana, Avalanche, etc.). That’s why most tokens you see on exchanges like Uniswap or OpenSea are actually running on Ethereum under the hood.

So, quick recap:

- Coins = native currency of their own blockchain

- Tokens = built on someone else’s blockchain

Understanding this difference is super important - it’s one of those things that separates beginners from people who really get crypto.

The Main Categories of Tokens

Now let’s talk about the different types of tokens you’ll run into every day. Each type has its own job in the crypto world.

- Stablecoins - The “safe” ones These are tokens that are designed to stay stable in price, usually pegged 1:1 to a real-world currency like the US dollar. The most popular ones are:

- USDT (Tether)

- USDC (Circle)

- DAI (MakerDAO - this one is a bit different because it’s over-collateralized and decentralized)

Why do people use them? Because crypto prices are wild. If Bitcoin drops 20% in a day, you can quickly move your money into USDT and wait out the storm without losing value. It’s like having digital dollars in your crypto wallet.

- Utility Tokens — The “access pass” tokens These give you special perks inside a specific project or platform. Examples:

- UNI (Uniswap) — gives you governance voting rights and sometimes fee discounts.

- LINK (Chainlink) — pays for oracle services.

- MANA (Decentraland) — used to buy virtual land and items in the metaverse.

Basically, if you want to use the service, trade on the platform, or get discounts, you need to hold the utility token. It’s like having a membership card that actually has real value.

- Security Tokens — The “dividend-paying” tokens These are more like traditional stocks or bonds, but on the blockchain. They represent ownership in a real company or asset and can pay you dividends or profit shares. Example: tokens that give you a cut of trading fees from a decentralized exchange.

- NFTs (Non-Fungible Tokens) - The unique ones Unlike all the tokens above, NFTs are not interchangeable. Each one is completely unique, like a digital collectible or certificate of ownership. Yes, most people first heard about NFTs because of crazy expensive digital art (Bored Apes, CryptoPunks, etc.), but that’s just one use case. NFTs are also used for:

- Digital tickets to events

- In-game items that you truly own

- Music rights and royalties

- Proof of attendance or membership

- Real estate deeds (tokenized property)

The beauty of NFTs is that they can represent literally anything unique. The technology is way bigger than just “jpegs”.

Quick Summary Table (for easy reference)

| Type | What it is | Main purpose | Examples |

|---|---|---|---|

| Coins | Native currency of its own blockchain | Powers the network, pays fees | BTC, ETH, BNB, AVAX |

| Stablecoins | Pegged to fiat (usually $1) | Stability, trading, savings | USDT, USDC, DAI |

| Utility Tokens | Access to services or perks | Discounts, governance, usage | UNI, LINK, MANA |

| Security Tokens | Represent ownership, pay dividends | Profit sharing, like digital stocks | Various regulated tokens |

| NFTs | Unique, non-interchangeable | Digital ownership of anything unique | CryptoPunks, BAYC, tickets |

So that’s the main breakdown! Once you understand coins vs tokens and the four big categories of tokens, you’ll stop feeling lost when someone starts throwing around words like “utility” or “stablecoin”. Next time you open your wallet, you’ll look at all those assets and actually know what each one is doing there.